The Role of Discounting and Negotiable Instruments in Corporate Finance

Exploring the use of discounting and negotiable instruments in modern corporate finance, including their benefits and real-world applications.

Summary

In the modern financial landscape, businesses frequently encounter the need for short-term financing to manage cash flow, bridge working capital gaps, or seize immediate growth opportunities. Instruments such as Discounting, Bills of Exchange, Promissory Notes, Commercial Paper, and Negotiable Instruments play a pivotal role in addressing these needs. This article delves into these financial tools, explaining their interconnected nature, how banks utilize them, and the benefits they provide to companies.

Understanding the Key Terms

-

Discounting: Discounting is a financial process wherein a bank or financial institution purchases a bill or note from a company at a value lower than its face value. The difference, called the discount, represents the bank’s fee or interest for providing upfront cash.

-

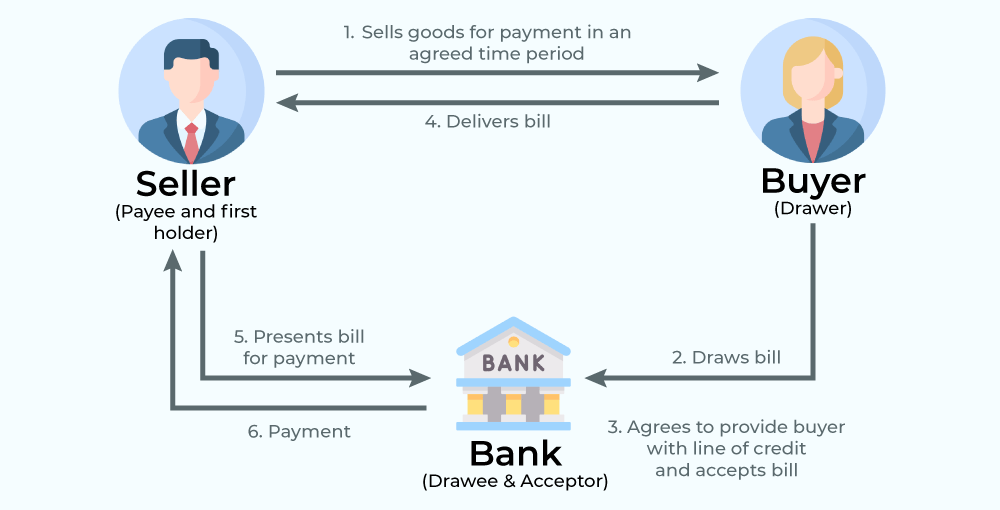

Bill of Exchange: This is a written order by one party (the drawer) directing another party (the drawee) to pay a specific sum to a third party (the payee) at a predetermined date. Bills of Exchange are widely used in trade finance.

-

Promissory Note: A promissory note is a written promise by one party to pay a specified sum to another party, either on demand or at a future date. Unlike a Bill of Exchange, it does not involve a third party.

-

Commercial Paper: This is an unsecured, short-term debt instrument issued by companies to meet immediate financing needs, such as payroll or inventory purchase. It is typically used by large, creditworthy corporations.

-

Negotiable Instrument: A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand or at a set time. Bills of Exchange, Promissory Notes, and Commercial Paper are all examples of negotiable instruments.

How Banks Use These Instruments

Banks play a central role in the functioning of negotiable instruments and their discounting. Here’s how:

-

Discounting Bills and Notes: When a business receives a Bill of Exchange or Promissory Note, it may not want to wait until the maturity date to access funds. Banks purchase these instruments at a discounted value, providing the business with immediate liquidity while assuming the risk of collecting the full amount at maturity.

-

Facilitating Trade: Banks act as intermediaries in trade transactions by verifying the authenticity of Bills of Exchange and ensuring that payments are made as agreed. This fosters trust between buyers and sellers.

-

Issuing and Purchasing Commercial Paper: Banks often help companies issue Commercial Paper by underwriting or distributing it to investors. They also buy Commercial Paper as part of their investment portfolios, supporting the liquidity needs of businesses.

Connection Between These Tools

All these instruments share the following commonalities:

- Liquidity Support: They enable businesses to convert receivables into cash quickly, facilitating smoother cash flow management.

- Risk Mitigation: By involving banks, companies reduce the risk of default from counterparties.

- Flexibility: Negotiable instruments can be customized to suit specific business transactions, whether domestic or international.

Practical Examples

-

Discounting a Bill of Exchange: A furniture manufacturer ships goods to a retailer and draws a Bill of Exchange payable in 90 days. To meet its payroll and purchase materials, the manufacturer discounts the bill with its bank, receiving immediate cash at a reduced value.

-

Using Commercial Paper: A tech company issues Commercial Paper worth $5 million to fund a new product launch. The paper is sold to investors with a maturity of 60 days at an interest rate lower than bank loans.

Benefits to Companies

- Improved Cash Flow: Discounting provides businesses with the funds needed to cover operational expenses without waiting for receivables to mature.

- Cost Efficiency: Instruments like Commercial Paper often offer lower interest rates compared to traditional loans.

- Enhanced Credibility: The use of Bills of Exchange and Promissory Notes demonstrates professionalism and trustworthiness in business transactions.

- Risk Sharing: Banks assume the risk of payment collection, allowing companies to focus on core operations.

Conclusion

Negotiable instruments and their discounting are indispensable tools for businesses navigating the complexities of short-term financing. Banks serve as critical enablers, providing liquidity, mitigating risks, and ensuring the smooth functioning of trade and commerce. By leveraging these instruments effectively, companies can not only manage cash flow challenges but also seize opportunities for growth and expansion.

References

- Fabozzi, F. J., & Modigliani, F. (2009). Capital Markets: Institutions and Instruments. Pearson Education.

- Mishkin, F. S. (2016). The Economics of Money, Banking, and Financial Markets. Pearson.

- International Chamber of Commerce. (2021). “Trade Finance Guide.” Retrieved from ICC.

- Federal Reserve Bank of St. Louis. (2020). “Commercial Paper Market and Its Role in Corporate Finance.” Retrieved from St. Louis Fed.

- World Bank. (2019). The Role of Banks in Trade Finance. Retrieved from World Bank.

Comments